Reading Time: 18 minutes

Did you know, there’s a decentralized world computer backed by blockchain tokens that has come to seriously rival bitcoin’s dominance?

Yes, its name is Ethereum and its tokens: ethers (ETH). And it’s got such a hot & active community.

I have had so many colleagues, friends, and family asking me how to buy Ethereum that over time I’ve started writing personalized notes and tips to send out. Especially for you, I’ve selected, organized and edited the best advice here.

The following comprehensive guide for beginners has the best tips and tricks to purchase, store, understand and safely use Ethereum.

You’ll learn the difference between Bitcoin vs Ethereum, ETH vs ETC, and Ethers vs Ethereum ICO tokens. Most importantly I will show you how to get Ethereum with a credit card, a bank transfer, cash, and PayPal. As a bonus, I’ll also explain how it’s possible to earn ETH buy using your own PC (mining), or using your own labor (freelancing).

Get ready, because you’re about to get buying Ethereum !

In a rush? Go straight to the best sites to buy Ethereum.

Contents

What Is Ethereum?

4 Quick facts:

- Ethereum is a public blockchain

- It’s a decentralized ledger on a peer-to-peer networ

- It uses a technology similar to that of bitcoin

- Ethereum comes with the capacity to run decentralized applications

Russian Canadian Vitalik Buterin wrote the Ethereum white paper in late 2013 while visiting San Francisco as a 17 year old. Before then, he wrote articles for Bitcoin Magazine and Bitcoin Weekly, two of the earliest bitcoin news websites.

In 2014, Vitalik dropped out of college after receiving a $100,000 Thiel Fellowship to work full time on cryptocurrencies.

While bitcoin impressed him, he thought its underlying technology could do more than support a digital currency. The specific programming language underlying bitcoin, however, was too rigid to allow for the development of more applications on top of it. Vitalik stated:

“Bitcoin was designed to be a [Simple Mail Transfer Protocol] SMTP. It’s a protocol that is very good at one particular task. It is good for transferring money, but it was not designed as a foundational layer for any kind of protocols to be built on top.”

In his white paper, Vitalik described a blockchain that could support decentralized applications (DAPPs) by acting as a Turing-complete virtual machine. The Ethereum blockchain would offer unlimited memory and computational power to execute infinite loops, necessary to support multi-applications.

In particular, Ethereum supports smart contracts, which are agreements written in code that auto-execute when certain predetermined conditions are met. The smart contract application on Ethereum creates an opportunity to automate and improve efficiency in trade, finance and even public administration processes.

After Vitalik published the white paper, he was joined by Charles Hoskinson, Anthony Di Iorio, and Mihai Alisie—among other developers—to write the code for the platform. In June 2014, they registered the Ethereum foundation in Zug, Switzerland as a nonprofit organization.

The foundation is not directly involved in the technical development of the platform. It manages funds for development, organizes Ethereum events and manages the official online communication channels and community forums.

In July, the foundation oversaw a public, 42-day initial coin sale, where 60,102,216 ethers (ETH) were sold for 31,591 BTC, worth $18,439,086 at that time. Ether is the native cryptocurrency of the Ethereum blockchain. It is used as a currency as well as the gas one needs to run applications on the platform.

Ether is the second cryptocurrency after bitcoin in terms of market capitalization and one of the fastest in growth. According to CoinDesk’s first quarter 2017 “State of Blockchain” report, bitcoin’s market capitalization grew by 11.4% to stand at $15 billion, while ether’s grew by 500% to reach $700 million.

The Ethereum blockchain also offers tools for companies, institutions and even individuals to create tokens. The valuation of Ethereum as a platform is therefore higher when we include tokens created on top of it and sold by third-party entities.

In February 2017, the Enterprise Ethereum Alliance (EEA) was launched. EEA is a consortium of over 80 financial, technology companies and blockchain startups seeking to improve Ethereum for businesses use. Members of the consortium include Microsoft, JP Morgan and Intel.

What’s the difference between Ethereum and Bitcoin?

| Ethereum | Bitcoin | |

|---|---|---|

| Usage | smart contracts | digital cash |

| Send | from a to b when condition = true | from a to b |

| Creator | Vitalik Buterin | anonymous |

| Started | 2015 | 2009 |

| First coins | pre-sold (US$18m) | instamined |

| Block time | ~15 sec | ~10 min |

| Security | Proof of Work (PoW) | soon: Proof of Stake (PoS) |

The difference between Ethereum and bitcoin starts with their founders. While we know the identity of Vitalik Buterin, we know little about the founder of bitcoin beyond the Satoshi Nakamoto pseudonym.

Ethereum is designed with the Turing-complete scripting language. This allows developers to arbitrarily design and run applications on the platform. While layers on top of bitcoin, such as Rootstock, are giving it the capacity to accommodate more applications, bitcoin is still far from competing with Ethereum.

Another difference is in the number of coins that will eventually be released. Bitcoin is deflationary because it is designed so that there will never be more than 21 million bitcoins in circulation. The last bitcoin is set to be mined sometime in the year 2140.

Meanwhile, there is as of yet no cap on how many ethers will ultimately be mined. There is a yearly cap, however, of 18 million new ethers released on the Ethereum platform. Mining could continue forever, unless the community agrees to change the protocol and cap the number of coins that will go into circulation.

One of the most important near-future events will be the changing of consensus-forming mechanisms for the Ethereum network from proof of work (PoW) to proof of stake (PoS). Making this switch would open an opportunity to cap the number of ether in circulation and thus make Ethereum deflationary.

The upgrade would also involve adding zero-knowledge protocol to Ethereum, which would increase user privacy. Zero-knowledge protocol is what Zcash uses so that its network can confirm the validity of a transaction without accessing details such as addresses and amount.

These changes would further differentiate Ethereum from bitcoin.

Ethereum has an easy scaling path compared to bitcoin. While the bitcoin block size is capped at 1MB, Ethereum’s expands and shrinks according to volume needs. This structure enables the Ethereum network to confirm blocks in 3 and 6 seconds, while bitcoin takes at least 10 minutes. Nevertheless, with adoption, Ethereum also faces pressure to scale.

What’s the difference between ETH and ETC?

Main points:

- ETH is the ‘official’ Ethereum chain that most people use

- ETC (Ethereum Classic) is the ‘rebel’ chain with a smaller community

- The community behind Ethereum Classic have core values similar to those of bitcoin

Ethereum (ETH) hard forked (became an offshoot) from Ethereum Classic (ETC) in July 2016. Ethereum Classic lost value, but its price has since risen again to make the cryptocurrency the fifth largest in market capitalization, compared to Ethereum (ETH) maintaining the second position.

A few months before, in March, German blockchain startup Slock.it had invited the public to invest in a decentralized anonymous organisation (DAO) they had worked on for months. The DAO was to be a virtual business enterprise that could contract others, as well as sell goods and services. Smart contracts and bots would execute its processes and split the profits among the shareholders of the DAO.

When the investment period closed in late May, over $160 million worth of ether had been raised.

Two weeks later, an attacker exploited an error in the DAO’s code and requested to cash out $50 million. Investors panicked and the entire Ethereum community worried the heist would taint the reputation of the platform. There was still time to stop the theft, however, because the smart contract the attacker exploited wouldn’t cash out until 28 days after activation.

Every effort to seal the loophole and deactivate the attacker’s request failed. As an act of last resort, some in the community proposed a hard fork. Releasing a new version of the Ethereum core software would invalidate the attacker’s transactions.

On July 21, a majority in the Ethereum network embraced the new version of the software core. Those who didn’t agree with the decision to upgrade chose to hold onto the old core software. The nodes that adopted the new software version retained the name Ethereum (ETH). Those that stuck with the old version rebranded as Ethereum Classic (ETC).

In the first week of the switch, most exchanges dropped Ethereum Classic and added the new Ethereum in its place. With time, however, it became clear that a determined Ethereum Classic community maintained a demand for the original cryptocurrency. The exchanges added it back as a coin independent from Ethereum. You can buy and sell ETC on Poloniex, Kraken and Bitfinex.

The difference between ETH and ETC is less technical and more philosophical. The community that stuck with ETC believes that it was wrong to intervene and that smart contract executions should never be altered, even if the outcome of letting them fully execute is not desirable.

The smart contract that the DAO attacker exploited worked as designed, according to ETC supporters, and they blame the contract developer for the error. To them, intervening to correct it and stop the hack went against the concept of immutability, which says transactions already on the blockchain should never be rolled back.

According to their view, intervention made transactions on the Ethereum blockchain no different than those performed through centralized systems, where transactions can be overturned after being confirmed.

Users are making their preferences known, however. They are choosing ETH over ETC. Fewer companies and institutions are creating tokens and smart contracts on the ETC platform.

Which are the best places to get Ethereum?

Quick tips to get Ethereum:

- Friends and relatives may give you Ethereum as gift

- You can mine it using your PC’s graphics card

- You can sell goods and services and get paid in the cryptocurrency

- Easiest & most common way to acquire Ethereum is to buy it from those who already have it (on an exchange).

Exchanges—which facilitate the buying and selling of cryptocurrencies such as Ethereum—have different requirements for using them. Some will require you to provide identification documents and others won’t. Some accept credit cards and bank transfers while others don’t. As with all cryptocurrency exchanges, I highly recommend doing your own independent research before using a service. You may like to read up about what makes for a good cryptocurrency exchange.

There are also sites that will sell you cryptocurrencies without considering where you are located on the globe, and there are sites that only serve clients from specific countries or regions.

Best places to get Ether:

Good sites to get Ethereum with a credit card

Coinbase and CEX.io are two exchanges where you can buy Ethereum and use a credit card to pay.

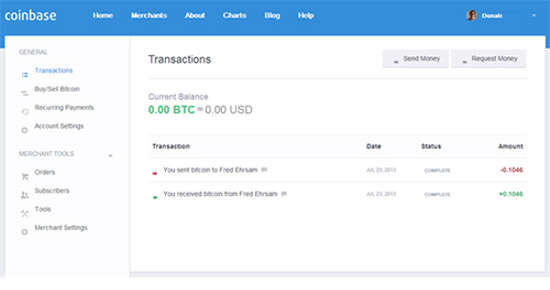

Coinbase.com

Coinbase supports the buying and selling of ether alongside bitcoin and Litecoin. According to CoinDesk’s latest “State of Bitcoin” report, about 34.4% of all purchases of ether using credit cards and bank transfers happen on Coinbase.

For every transaction you do on Coinbase, depending on the country from which you are buying, you pay a fee ranging between 1% and 4% of the value of the transaction. It’s free to deposit fiat currency to buy ethers, but a wire transfer attracts a flat rate fee of $10.

Coinbase is registered in the US as a money transmitter business and thus it observes all Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. The exchange requires all customers to share government-issued identification documents.

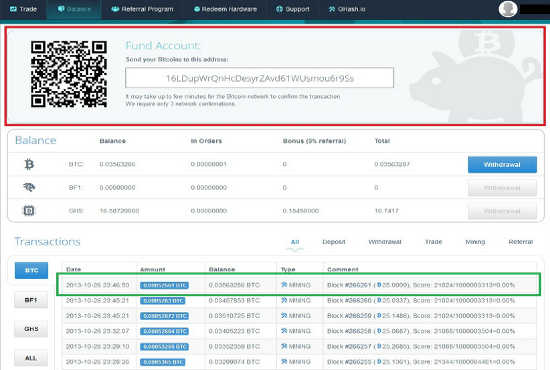

Cex.io

CEX started as the Ghash.io bitcoin mining pool before adding an exchange to its list of services. In 2014, it closed down Ghash.io to concentrate on the exchange business. The company is registered in the US as a money transmission business. It therefore requires its customers to provide identification so as to meet KYC and AML regulations.

CEX supports most countries around the world, but restrictions, such as the number of transactions allowed per day, apply to different countries.

When you sign up on the platform, you can choose from three types of accounts. A basic account will allow you to buy ether worth no more than $500 daily and $2,000 per month. A verified account, which means you’ve provided a government issued identification document, will allow you to buy up to $10,000 of ether daily or $100,000 in a month.

Accounts created by corporate entities and verified by the exchange do not have a limit of the amount of ether they can buy daily or monthly.

No fees apply when you deposit fiat currency for buying cryptocurrencies through bank transfers. Credit cards, however, attract a 3.5% fee and $0.25 commission. The exchange will also take 7% of the amount of every purchase you make. And they expect you to take care of all costs involving conversion to US dollars, since that is the denomination used on the platform.

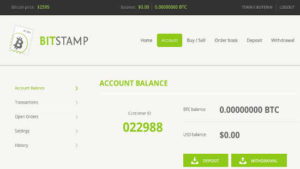

Bitstamp.net

Bitstamp is planning to add Ethereum very soon (right after they add Litecoin). Based in London, Bistamp accepts Mastercard, VISA, and bank transfers. Bitstamp is currency one of the largest European crytpocurrency exchanges. Currencies available for depositing: Euro & US Dollar.

Best places for buying Ethereum with cash

In 2017 the best way to get Ethers using cash would be to use Coinmama.com or go through a person2person bitcoin exchange service like Localbitcoins. At the time of writing, no platform or service exists to buy Ethers using government issued Fiat bank notes.

Plenty of similar alternatives to Localbitcoins exist. For example you could use a Bitcoin ATM. Just search for services that let you buy Bitcoin using cash.

Once you have exchanged the cash for Bitcoin then just use a cryptocurrency exchange to convert the Bitcoin into Ethereum.

Good places to get Ethereum with a bank transfer

Most exchanges trading ether accept bank transfer as a means of making fiat deposits to buy the cryptocurrency. In this category, however, we will look at Kraken and Gemini.

Pro tip: Many beginners prefer Coinbase as they also accept bank transfer deposits. I would recommend you try Coinbase.

Kraken.com

Kraken was founded in 2011 in San Francisco by Jesse Powell and was among the first bitcoin exchanges. It has grown to be the biggest in euro volume and liquidity and it added ether to the list of cryptocurrencies it supports in August 2015. The exchange also included Ethereum Classic after the split in July 2016.

Kraken serves clients in the US, Canada, Japan and the European Union. The exchange charges fees per trade that range between 0% to 0.26%, depending on whether you are buying or selling and which currency you are using.

Deposits and withdrawals cost about 0.19%, with the least amount you can withdraw or deposit capped at $20 or 5,000 yen.

Gemini.com

Gemini was founded in late 2015 by the Winklevoss twins, who are best known for claiming that Mark Zuckerberg stole the Facebook idea from them. The exchange is available to users in 26 states of the US and trades both bitcoin and ether.

The exchange is registered as a limited liability trust and demands its users provide government-issued identification documents and an address. It is free to deposit and withdraw from the exchange, but buying and selling costs 0.25% of the value involved.

Best sites to exchange Bitcoin for Ether

Sometimes using fiat currency (via credit cards or bank transfers) to buy ether is often difficult because banks want to distance themselves from cryptocurrencies. Using bitcoin instead is faster and doesn’t require the services of a bank or traditional financial institution. It also does not require that users share personally identifying information.

Do keep in mind that some exchanges are under obligation to ask for limited identity verification even when the user is buying ethers with bitcoins or other cryptocurrencies.

Close to 90% of purchases of ether are done with bitcoin. Among the most used exchanges where you can buy ethers using bitcoin include Poloniex, Shapeshift and Yobit.

Poloniex.com

Poloniex handles about 69% of all purchase of ether (through bitcoin). The majority of exchanges started with bitcoin as their only cryptocurrency. Poloniex however was launched in January 2014 to facilitate trading of altcoins.

Since Poloniex primarily moves value between cryptocurrencies and digital assets, it has avoided the banking blockade that most of the other exchanges have had to endure. Nevertheless, it observes regulatory requirements expected of any financial institution and asks its users to provide identification documents.

The exchange uses the maker-taker model, which means it matches buyers and sellers. The platform charges both the seller and the buyer a percentage ranging between 0.05% and 0.25, depending on the amount involved. The larger the amount of ether you buy, the lower the cost you incur in fees.

Shapeshift.io

Shapeshift also serves as an exchange for altcoins and has a strict no-fiat policy. It is also one of the few exchanges where you can buy ether or any other cryptocurrency without opening an account. The exchange does not ask its users to identify themselves in any way.

You can use Shapeshift from anywhere around the world except New York and North Korea. The exchange only charges miner fees when you deposit, trade and withdraw.

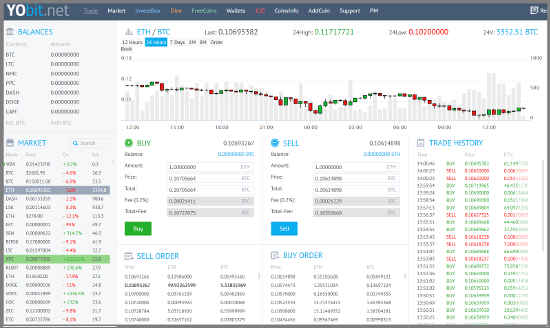

Yobit.net

Yobit serves as a nice Poloniex alternative for trading many major and minor cryptocurrencies. Based in Russia, Yobit has sweeped up a considerable portion of the altcoin exchange market after the demise of Cryptsy. Ethereum volumes are impressive, with 10 to 15% of the global market being trading on Yobit. I like the interface and the website responds well. Withdrawing and depositing on Yobit is really simple and there’s none of the verification hassle you would expect on ‘western’ exchanges.

Best places to work for Ethers

Ethereum as an ecosystem has many work opportunities. Since it is an open-source software project, if you are a skilled developer, you could contribute code on the Github Ethereum depository. If your contributions are valuable, the Ethereum foundation could fund you.

Ethereum as an ecosystem has many work opportunities. Since it is an open-source software project, if you are a skilled developer, you could contribute code on the Github Ethereum depository. If your contributions are valuable, the Ethereum foundation could fund you.

You can also build applications on top of the blockchain for third-party entities such as companies and institutions. The jobs and skills section of the Ethereum community forum is always updated by entities looking for help with developing applications on Ethereum protocol.

In addition to developers, thousands of startups using the Ethereum blockchain require traditional talent—such as lawyers, marketers, web designers, graphic designers, writers and accountants—to reach their goals.

These non-technical, mostly freelancing jobs require only a general understanding of how the platform works. These jobs are also often posted on Ethereum forums and freelancing sites. Coinality is a useful site for tracking job posts from companies and startups looking for Ethereum talent and skill.

Earning Ethers by mining (using your graphics card)

When Vitalik wrote the Ethereum white paper, many of bitcoin’s weaknesses had started to show. One of these weaknesses was the mining hardware race. In the early days of bitcoin, central processing units (CPU) were sufficient to do the mining.

When Vitalik wrote the Ethereum white paper, many of bitcoin’s weaknesses had started to show. One of these weaknesses was the mining hardware race. In the early days of bitcoin, central processing units (CPU) were sufficient to do the mining.

As competition grew, miners moved to graphic processing units (GPUs). The mining of bitcoin has since moved to ASICS, which consume a lot of electricity and confine mining to VC-backed companies.

Ethereum limits mining hardware to GPUs. It uses Ethash proof of work, a version that uses the SHA-3 hashing function, rather than bitcoin’s SHA-256. Ethash is resistant to ASIC mining chips.

Mining with graphic processing units (GPU) makes it easier for anyone to mine because the hardware required is not expensive to acquire and the electricity consumption is not as high as with bitcoin mining.

What are the best wallets for storing ethers?

Remember this:

- Online, web, and mobile wallets are insecure but good for small & fast payments

- Hardware and paper wallets are the most secure means to store Ethereum

- Multi-sig wallets allow multiple parties to agree on transactions

Ethereum has fewer options to choose from for wallets as compared to bitcoin. Like bitcoin, however, the existing variety includes desktop, web, mobile, hardware and paper wallets. One brand of wallet can exist with several of these varieties, using syncing capabilities to allow users to move from one form to another, depending on need.

You may also like to read up on the differences between hot and cold wallets (level of online connectivity & security).

Web wallets

Web wallets are accessible through a browser or a browser extension. They are convenient to use, since you don’t need to download and install an application. You can also use them from multiple devices.

The most used Ethereum web wallet is MyEtherWallet.com. While you access the wallet through a browser, you have the option of downloading the private keys to your local device. The wallet also uses client-side JavaScript to store keys and transaction data on the browser of your device. The service provider doesn’t keep or access your private keys.

Other Ethereum web wallets that use client-side JavaScript include Ethereum Wallet and EthAddress.

Many wallets that you access as mobile or browser applications also have desktop versions. A case in point is Coinbase, which holds both bitcoin and Ethereum. While you can download the Coinbase wallet to your mobile device, you can also access your wallet through a web browser.

Ethereum as a platform has its own browser, known as Mist, through which you can access the decentralized applications on the platform. The browser comes with an inbuilt wallet. To use it, you need to download it onto your desktop, which makes Mist technically a desktop wallet.

The downside to using web wallets comes from their contact with the internet, which makes them vulnerable to hacks. They are convenient for keeping smaller amounts of ether. For larger amounts, however, you should use cold storage wallets, which don’t come into contact with the internet.

Smartphone wallets

Smartphone or mobile wallets are more convenient than web wallets. A phone fits in a purse or pocket to carry around, and having your ethers in it makes it easy to spend on the go. Smartphone wallets also come with scanners, so if you need to make a payment, you can capture the QR version of the recipient’s address instead of copying it.

The majority of mobile wallets that hold bitcoins hold Ethereum as well. Ethereum has the second highest number of mobile wallets after bitcoin.

The most used Ethereum-only mobile wallet is made by Freewallet.org which has built wallets for over 15 cryptocurrencies. The wallet is available for both iPhone and Android. Ethereum Wallet comes with an in-built exchange and has a user-rating of 4.2/5 on GooglePlay.

Among multi-coin wallets, Jaxx is a popular option. It has a simple user interface but with advanced features. It is also integrated with the Shapeshift cryptocurrency exchange, allowing you to easily move between most major coins within the app. This wallet is also available for Android and iPhone.

The disadvantage of smartphone wallets is that, like web wallets, they are hot wallets—in contact with the internet. This makes them susceptible to hacking and other forms of remote attacks.

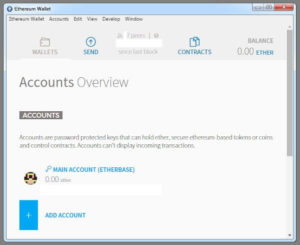

Desktop wallets

The first bitcoin wallet was an application you downloaded and installed on your local computer—a desktop wallet. With Ethereum, it turns your desktop into a node in the peer-to-peer network, a feature that you don’t get by using other types of wallets. Most of thet time, installing a desktop wallet involves downloading the entire Ethereum blockchain—the record of all transactions since the 1st day of the cryptocurrency’s existence.

With most Ethereum desktop wallets, you connect directly to the network. You don’t go through a third-party wallet service provider, which means you remain in full control of your private keys.

The Mist Ethereum Wallet is the official or main desktop wallet. Aside from holding ethers, it also holds all tokens and contracts created on the blockchain by institutions, companies and even individuals. It is very secure and works well with the system. It is also the wallet you would use as a developer or miner. Be aware that ETC (Ethereum Classic) users should download it from Ethereum Classic’s Github page.

Another desktop wallet that I like is called Etherwall. It supports both Ethereum and Ethereum Classic and was the first Ethereum desktop wallet.

The disadvantage with the two desktop wallets above is that you have to download the entire blockchain onto your computer. This requires substantial space or memory. Since your desktop becomes a node in the network, the cost of data consumption is high.

Jaxx do also have a lightweight desktop wallet (Windows & Linux) which does not require you to download the whole Ethereum blockchain.

Hardware wallets

Hardware wallets are designed specifically to hold the private keys of a cryptocurrency. Like mobile wallets, they are convenient to carry around, but they offer better security with a layer of encryption.

They are often used as cold storage. They don’t come into contact with the internet, but instead sign transactions offline before broadcasting them online. There are currently three hardware wallets for Ethereum: Trezor, Ledger (Blue and Nano S), and KeepKey.

Trezor first designed their wallet for bitcoin. They started supporting Ethereum in early 2017 when they integrated with MyEtherWallet.

Ledger Nano S is the cheapest of the Ethereum hardware wallets on the market. It has a screen through which you confirm every transaction you sign.

KeepKey is more of a mini computer than a microchip device like the other two. It has the biggest body of all the three and thus is the most fragile.

The downside of hardware wallets is that they are the most expensive to own in terms of initial cost. Prices range between $50 and $260. They are in fact the only type of wallet you need to buy. The rest are either free and open-source software, or they make money by charging a fee for every transaction.

Paper wallets

By creating a representation of a public key and its corresponding private key on a piece of paper, as either a long string of alphanumeric characters or as a scannable QR code, you create what is know as a paper wallet. Since paper wallets don’t exist in digital form and don’t connect to the internet, they are not vulnerable to remote hacking. They are considered a form of cold storage for Ethereum and other cryptocurrencies.

Paper wallets are vulnerable, though, in other ways. For instance, they can be destroyed in fire or flood disasters. They can also be stolen if they are not well kept. Some steps users take to secure their paper wallets include keeping them in safety deposit boxes at banks or post offices.

To generate and print wallet details, you will need to use a wallet generating website. The most used ones for Ethereum are Myetherwallet.com, EthAddress.org and a Walletgenerator, all of which use client-side JavaScript.

To securely generate and print a paper wallet, download the website to your desktop. This will allow you to cut the internet connection so as to avoid an attacker snooping and stealing your wallet data. The entire process of creating the wallet should take place offline.

To further secure the wallet, clean the cache of your computer and printer, if it connects to the internet, before reconnecting.

What are ICOs and token sales on Ethereum?

While Ethereum has ether as its native currency, the platform offers tools with which anyone can create tokens to use as currency or token values. The development team has provided a guide you can use to do this.

Tokens created on Ethereum can be used in many ways, including as shareholding tokens sold to the public to fund startups and projects. The selling of tokens to raise capital is known as an initial coin offering (ICO). The term “ICO” is a play on its predecessor term “IPO” (initial public offering) using in regulated stock markets. Investopedia defines an ICO as:

“An unregulated means by which funds are raised for a new cryptocurrency venture”

According to CoinDesk’s 2017 first quarter “State of Blockchain” report, ICOs were the source of a third of the venture capital that went into blockchain startups in the beginning of 2017. More startups are anticipated to choose that path as the preferred early-stage funding mechanism.

Closing thoughts…

Ethereum is blessed with a very disruptive value proposition, a solid community, and strong acceptance from within the leading tech and financial institutions. The cryptocurrency is going through a rapid growth phase since early 2017. Be cautious when investing: only use what you can afford to loose. There is tremendous potential, and I would recommend you get a head start by reading up further on the technical details explaining how Ethereum, Ether, Gas, and mining works. Even having a basic general understanding of the driving factors will set you apart from the majority.

Good luck… and be prepared, because crypto is not going to stop revolutionizing our world as we know it.

More about us at HowtobuyEthereum.io and privacy policy.

Why do you say that bitcoin’s first coins were instamined? The first block halving didn’t happen to a year or two after 2009, so there was no way to instamine. It’s not like bitcoin was some crappy altcoin where the founder(s) rapidly mined a load of coins at launch.

You have a point – bitcoin was definitely not instamined in the way that certain altcoin founders have deliberately done so in the past. Though when I refer to the bitcoin “instamine” I’m underlining the fact that satoshi owns between 40 and 50% of all btc in existence – and this only because not many other miners were around until mid 2010. Satoshi gathered virtually all those early coins by mining on his own more or less for a year.